Streamlining compliance, collaboration and client care with FYI

Marks & Co is a long-standing accountancy firm based in central Brighton. Founded in 1977, the two-partner practice supports around 1,400 clients, primarily small business owners.

Under the leadership of Henry Speight, David Hall and Esther McPhail, his fellow partner and manager, the team has consistently embraced smart technology to drive efficiency – without losing the personal touch. FYI has become a key part of that journey.

Making the leap from legacy systems

Before FYI, Marks & Co relied on Virtual Cabinet, a server-based solution offering basic email capture and e-signing functionality. However, with recurring server crashes and limited scalability, Henry knew it was time for a change.

It wasn’t until a fellow accountant mentioned FYI during a webinar that Henry found a better solution.

After a few conversations, including with FYI’s Australian founder, the firm became an early adopter during lockdown in 2020.

A familiar feel with so much more

Henry describes FYI as the natural next step: “It felt familiar to what we had used before, but more powerful. We could access everything from any computer, which was essential during lockdown. Plus, FYI, just did more – more automation, more collaboration, and more responsiveness to suggestions.”

What stood out was how quickly ideas were implemented. “They actually listen. If you raise a suggestion, you might see it built in within weeks.”

Easy onboarding and seamless migration

Migrating years of data was handled seamlessly by FYI’s team. “They just logged into our database overnight – and the next day, everything was there,” Henry explains.

Staff training was straightforward too. “We had a live webinar just for our team and within an hour or two, everyone was on board.”

Better teamwork and smarter communication

FYI quickly improved internal collaboration. “If I receive a scanned letter I don’t recognise, I can just message our admin team directly within FYI to ask what it is or if anything is missing. No emails. No delays.”

When it comes to client communication, things are just as smooth.

“If a client asks for a document, it’s easy to find and forward on. Everything’s labelled properly and filed consistently. We haven’t fully embraced the client portal yet, but even without it, the process is quick and tidy.”

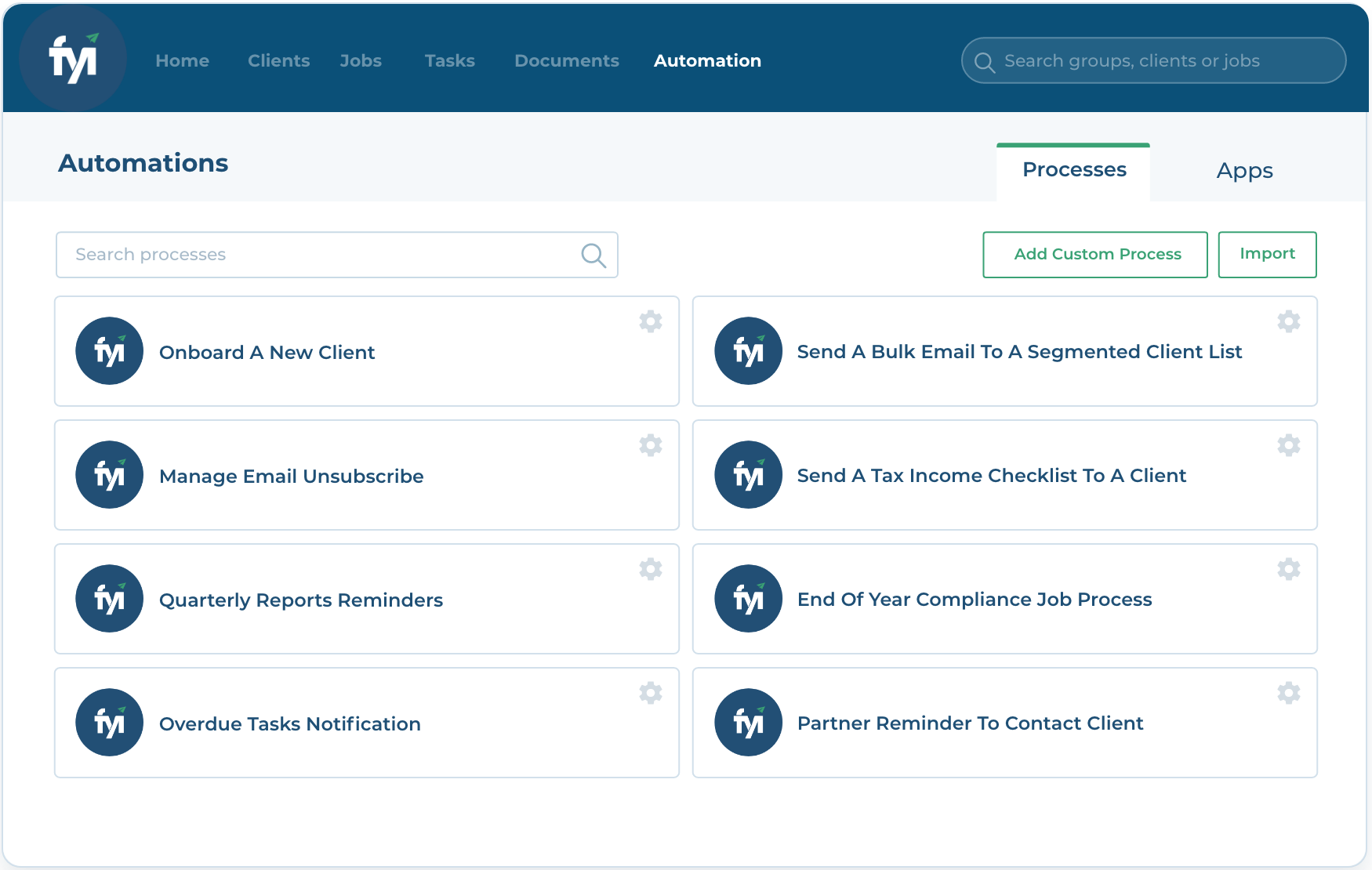

Automating the client journey – from tax to MTD

Automation is where FYI truly shines for Marks & Co. Previously, client reminders were manual and inconsistent. “We used to send a mass BCC email from Outlook to all our Self Assessment clients. Now, the system knows who’s sent their records and who hasn’t, and sends out nudges at the right intervals. It keeps the momentum going.”

FYI also integrates with Companies House, enabling automated reminders for filing deadlines and alerts if a company is struck off or has changes to its registered address. “It’s a great early warning system. One client’s details were fraudulently changed – and now we get notified as soon as something like that happens.”

Preparing for Making Tax Digital (MTD) has been another success story.

Preparing for MTD, not reacting to it

With the first wave of MTD for Income Tax due in April 2026, Marks & Co knew they had to act early. “We didn’t want to wait for HMRC to force the issue,” says Henry. “We needed a way to segment our clients, communicate with them clearly, and keep a record of who’s ready and who isn’t. FYI made that easy.”

The team used their tax software to identify clients above the £50,000 threshold and created custom fields within FYI to flag MTD readiness by client group.

“We’ve tagged clients by whether they’ll be affected in 2026, 2027 or 2028. Now we can generate accurate reports and act accordingly.”

Client communication at scale—without the chaos

Once they had the right segmentation in place, Marks & Co built out automated communication flows.

“We created a Typeform questionnaire and used FYI to send it out to the relevant clients,” explains Henry. “It asked simple questions: Do you feel ready for MTD? Will you need our help? What software are you currently using?”

The responses were fed directly back into FYI via its integration with Zapier, ensuring all data was stored alongside the client record. “No more spreadsheet chaos, no more wondering who we’ve contacted. It’s all there in one place.”

Although not all clients replied, the firm is preparing follow-up campaigns using the same approach. “We’re ready to hit send on another round of emails with stronger nudges. As MTD gets closer, the urgency increases—and FYI gives us the structure to manage that.”

Looking ahead to the next digital milestone

Henry believes this is only the beginning. “MTD is pushing the industry to modernise—and firms that don’t act now are going to be on the back foot. We’re hoping HMRC opens up more APIs so we can plug in even more data, like payment status or compliance triggers, straight into FYI.”

A word to other practices

For other firms still using spreadsheets, disjointed tools, or manual methods, Henry’s advice is clear:

And yes, he has recommended it. “We told Clearstone Bookkeeping – a local firm we work closely with – to give FYI a try. They’ve now adopted it and are using the automations too.”

A modern practice, powered by FYI

Marks & Co has transformed how it collaborates internally, connects with clients, and prepares for the future.

Want to learn how you can utilise its range of features to improve the efficiency of your practice and help clients prepare for key regulatory changes, like Making Tax Digital?