The modern income tax return process

Last week, our CEO and Co-Founder, Rob Cameron, had the pleasure of joining a live panel together with Ethan Cooney from Practice Ignition, Rebecca Mihalic from BusinessDEPOT, and Breanna Martin from Xero. They discussed the benefits of automating your practice and demonstrated how simple repetitive processes like income tax returns can be seamlessly automated using Xero, Practice Ignition and FYI.

Don’t believe us? Here’s how easy it is……

Here’s what the automated process looks like in each of the different tools, so you can actually see the client outcome, and what it would look like for your firm.

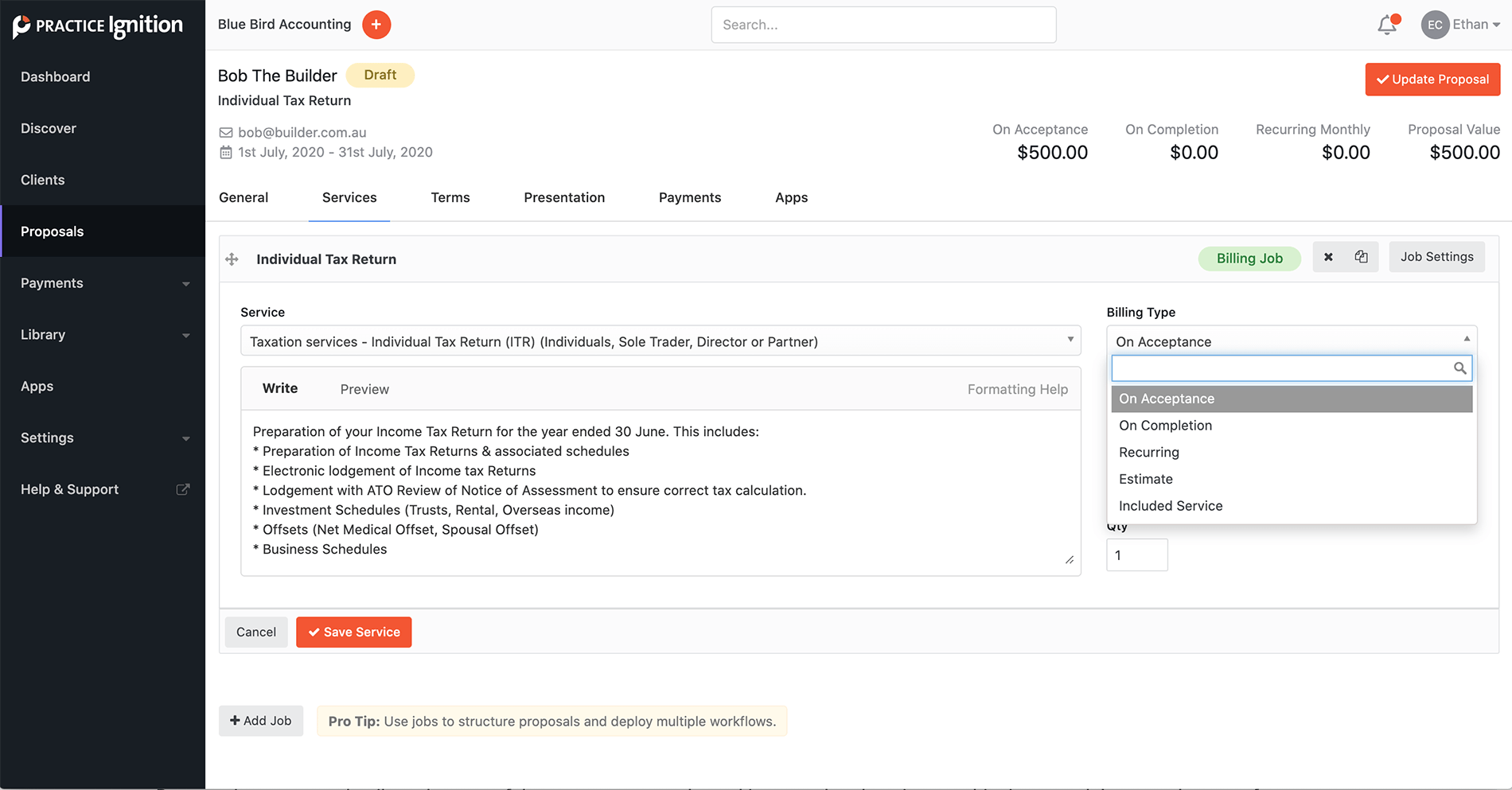

Step 1: New Client Proposal

Start in Practice Ignition. Simply select the client, choose the start and end date for the proposal, and define which services you want to include. You will also be given the option to bill for the services upfront, or on completion of the job.

By capturing payment details at the start of the engagement, you’re making sure that there is no ambiguity around the agreed scope of work. It ensures that clients value the time and expertise that they’re paying you for. You can amend your agreement in the future; if there’s a change to the scope of work.

Then, select the relevant engagement letter – driven off a template, and automatically pre-filled with all of the client information, the scope of the work, the payment schedule, and all the necessary authorities.

You can also customise your presentation. For example, by including a marketing brochure or even a quick video and a personal message. That way, your client receives a dynamic and engaging proposal. It might include a summary of your accounting services, some client testimonials, a video to guide them through the proposal, the scope of work, payment schedule, the opportunity to add payment details, and then digitally sign your engagement. So, all the client has to do is tick the box to digitally sign and accept.

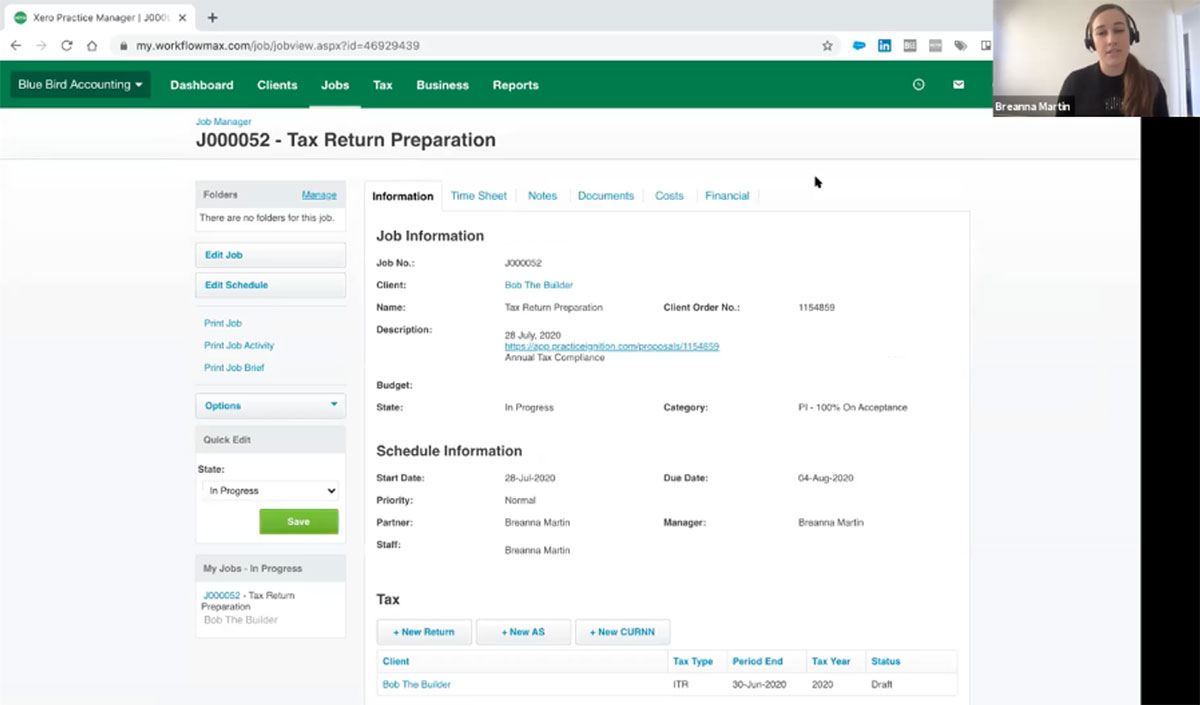

Step 2: Track Your WIP

The job will automatically be created in Xero Practice Manager and populated with the information from Practice Ignition, so a lot of the hard work has been done for you.

You can track how you’re going with WIP, link to the original proposal, enter a budget for the job, and if necessary, pull reports on that budget field to make sure proposals are billed accurately in the future. You can also set milestones and tasks, mapped to your services in Practice Ignition.

At the end of the workflow, a WIP wash-up can easily be done in your WIP dashboard, to see if you recovered your time.

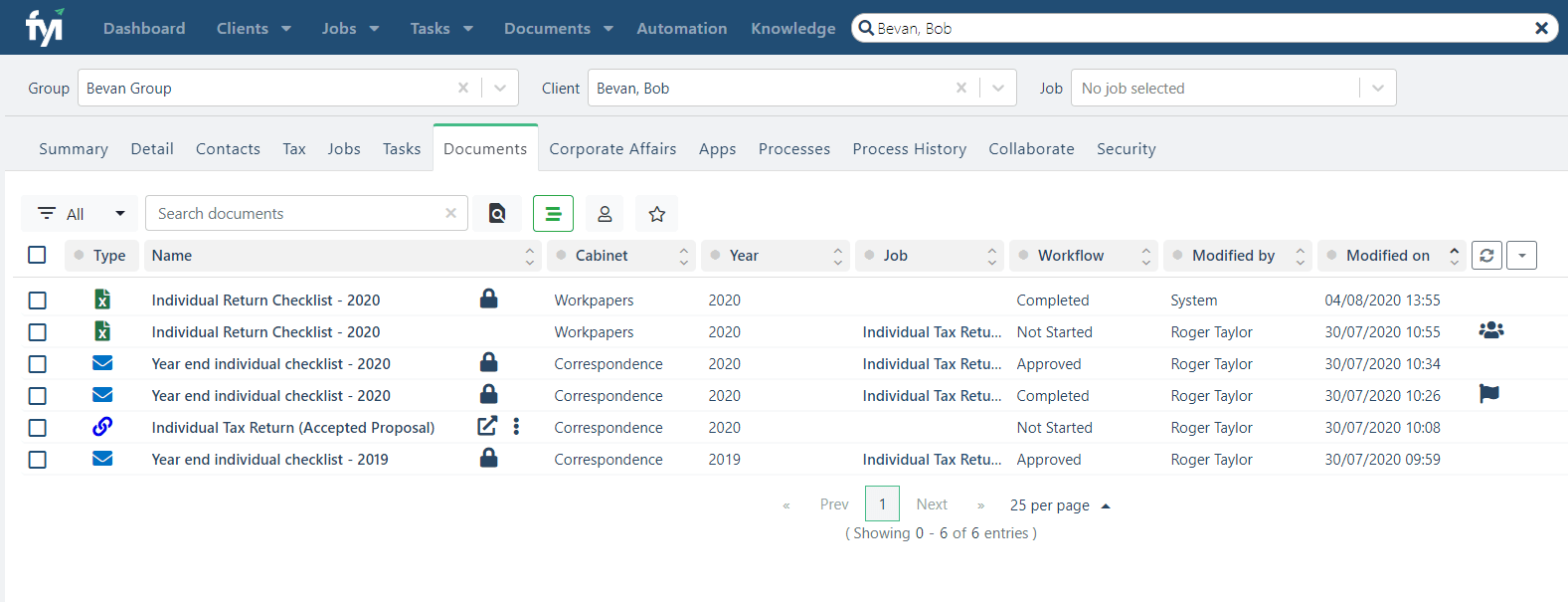

Step 3: Automate Client Communication

FYI can automatically import a weblink to the proposal, and file it for you against the client file.

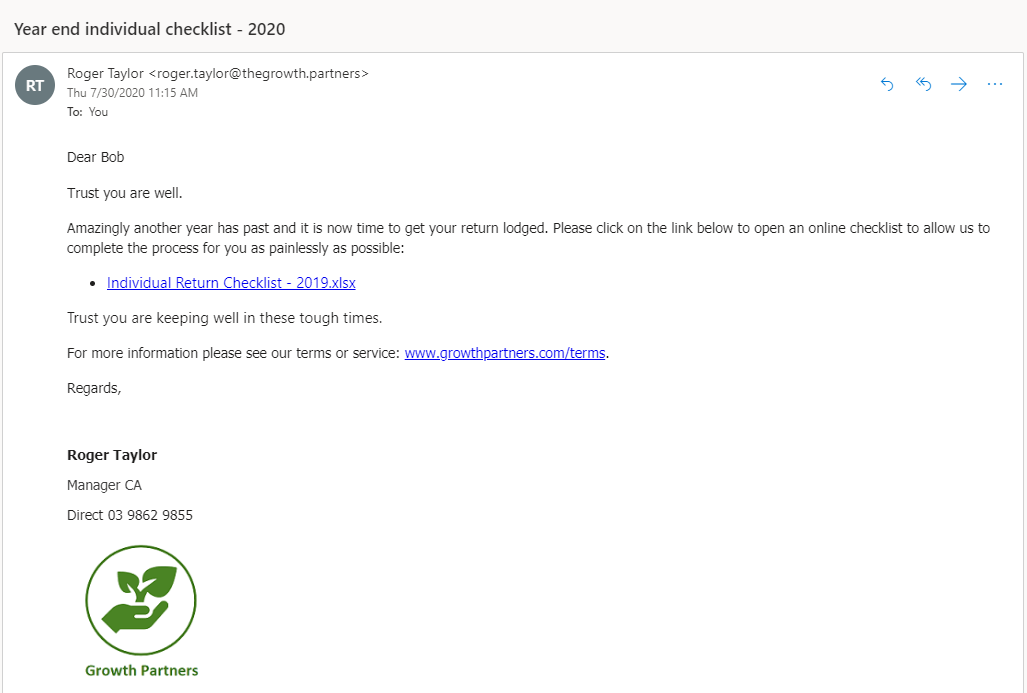

More importantly, you can automate whatever is the next part of your process. The job created inside of XPM can automatically trigger FYI to create an individual checklist – say in Excel or whatever office technology you prefer – using a template and applying it to the client in question. FYI can also automatically create a client email referring to the checklist and, if you want, even send it automatically, with no intervention.

From there, clicking on the link, sends your client to a capture point, taking advantage of Microsoft OneDrive, so the client can fill in the information online. In the example below, we’ve used a protected spreadsheet, and you can also include some dynamic elements, such as providing a link to a secure location where the client can upload documents such as tax receipts, and FYI will automatically import them.

Conclusion: What are the benefits?

Want to see FYI in action? Join an online demo, and let us give you a platform tour or show you how to get started.

And if you’re ready to experience the transformation FYI will make for your practice, sign up for your 30-day free trial today.