15 minutes with FYI’s Founder and CEO, Rob Cameron, on his journey so far

What does FYI do? What would be your elevator pitch?

FYI is the Swiss army pocketknife for the 21st-century accounting firm. The core problem we solve is document management, with a solution built for purpose, paperless offices in the Cloud. Beyond that, we leverage process automation technology to cut down the daily tasks that accounting firms are required to undertake, therefore reducing workload and freeing up time for the teams to work on other things. This new way of working brings added benefits through the ability to collaborate and share information more effectively. This creates a flywheel effect and firms become more and more efficient, the more they automate.

What is your background and how did FYI come about?

For me, like a lot of people’s careers, it was a series of coincidences and various events that drive you in a certain direction and then opportunities arise. I started as a chartered accountant many years ago with what was then known as Pricewaterhouse, and then moved through some other similar firms for about five years before I got what I regard as my ‘big break’. This was a chance encounter with a gentleman called David Smith who was Chairman – or the head – of PKF Australia at the time. I moved from Adelaide to Sydney to head up a team there. During this time, I taught myself to code and ended up rolling out a paperless office solution across a firm of about 500 people around the country. This was around 1997, when the concept of a paperless office was quite revolutionary, and firms were just starting to move this way. Emails were fast becoming a primary vehicle for business communication; and it was all about search – the ability to do full tech searching and find stuff within seconds.

Did that give you the passion for the tech space and accounting and where it can go, the possibilities?

Absolutely, I looked around at the results we were getting and it was mind-blowing back then. I guess innovation is a big part of my DNA. I like problem-solving and that is essentially what innovation is. Finding better ways to work. We realised the size of the document management opportunity, and it’s become a crusade ever since.

FYI has revolutionised accounting, specifically cloud document management and process automation. How does the positive feedback from the industry make you feel?

The feedback we’re getting at the moment is sensational and naturally, it makes the whole team feel great. The amazing thing is I believe we’ve only just started.

Looking at what’s ahead of us, we’re probably only at 50% of what the full possibilities are.

The crusade continues and that is what gets me up in the morning – keeping going forward. It’s such an exciting industry because no day is the same as the one before. We’re always looking to improve and innovate.

Fast-forwarding a little bit, when did you conceptualise FYI and decide that ‘this is the way to address the challenges accountants face’?

Prior to FYI, I founded a number of successful tech start-ups including Level 31, a document management solution for professionals that facilitated the move to a paperless office with a focus on email management. This was acquired by MYOB in 2006. I then spent a number of years working for MYOB, ultimately as their Global Head of Product Strategy. I left and started another company called Dovetail, an automation platform for bookkeeping and virtual CFO services which was also acquired by MYOB.

I started to work on FYI around 2016, and we launched in Australia towards the end of 2018. It wasn’t until I attended Xerocon in Brisbane soon after we launched, that I had a kind of ‘ah-ha’ moment, when I saw the scale of the Xero ecosystem in full effect. Before that, I understood the power of the Cloud and what it would bring to many businesses, but how can anyone not be impressed by how Xero’s ecosystem was benefiting the end users? The Cloud offers nearly infinite storage, working from anywhere, ultimate connectivity, and in addition to all that, Xero’s app partners offered all these different solutions for anything you can imagine, all working together. I thought back to my days in the 90’s moving heritage companies to paperless and I thought ‘if only some of the older characters back then could see this now?’ It would probably blow their socks off!

What did you think were the main benefits of this way of working?

All the things we are almost taking for granted now. Working from anywhere, nearly bottomless storage capabilities, and amazing UX and usability. I think the one we didn’t realise at first was the open architecture. This is what drives the ecosystem, and the ability to have huge innovation because you’ve got best of breed specialist solutions, you’ve got that natural creativity, and everyone is out there inventing. All the pieces can connect and everyone gets the result they need.

When did you realise you were on to something this big?

I think it was when we started considering the hyper repetitive nature of accounting and realised how much of it can be automated. People were thinking about how to file emails and getting caught up in drag and drop, for example, and we just said: ‘let’s automate it based on email addresses’. From there we thought about other filing that can we automate, and we realised we can automate 50%-70% of the filing per day. That’s a huge burden we are alleviating for accounting firms. People always want an easier way to work – who wouldn’t? Well, we realised we had the capacity to offer it.

Of course, there is a lot more that FYI also does. What’s your favourite FYI feature that, maybe, other people are not aware of?

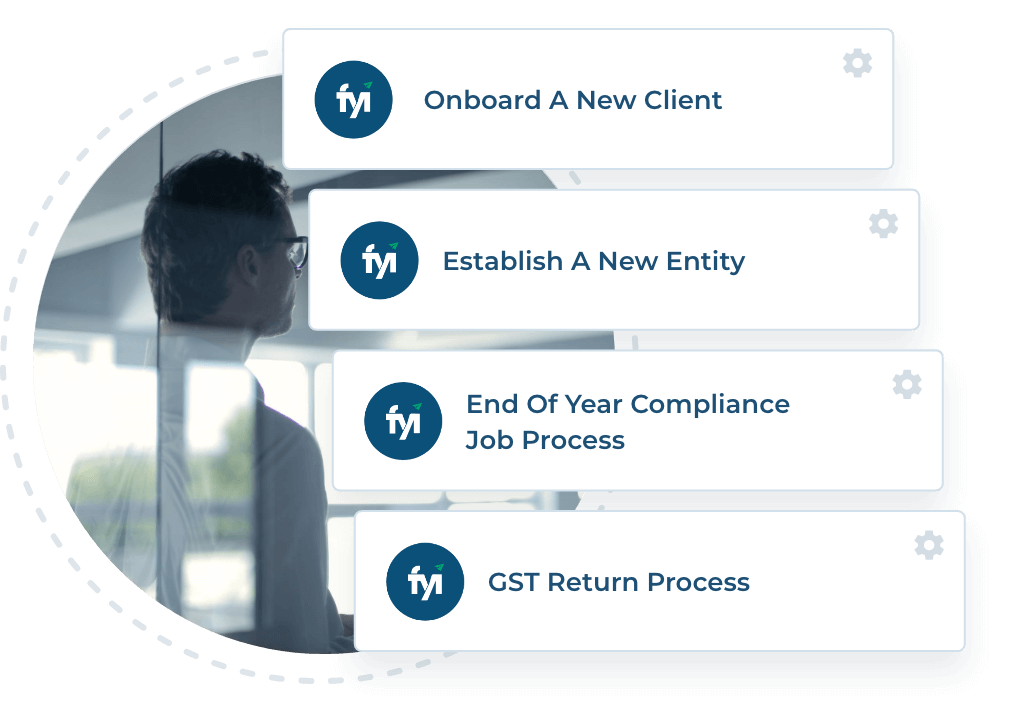

Probably automation is my favourite feature, but people don’t realise how much its being under-utilised right now, or what we can automate in the near future. My dream is that the typical practice, within three months of beginning with FYI, has 30 to 40 automations running, and they range across marketing, practice admin, compliance, financial services, and more. Even internal HR. FYI aims to give you the option to automate anything repetitious.

The other thing we aim to do is break down the walls between the client and the accounting firm so that collaboration is seamless and frictionless, and everyone can actually work like they’re part of one team, not two separate companies occasionally having blockages.

Tell us about the adoption benefits that Cloud software, such as FYI, brings to traditional companies who might be on the fence?

We’re a traditional profession so sometimes change is hard for some companies. But the risk-reward of trying cloud software compared to buying hardware back in the day is a huge difference these days. There is very little risk now. In the old days you had to deploy hardware and make a massive project team and if you made a mistake, really, you couldn’t get out of it in under two years because otherwise you’d have to write everything off.

With cloud software today, if it doesn’t work in three months – not that you want to – but if you have to move on to another software, you can. It’s not that big a deal. And you also have the ability to try before you buy.

Do you have any plans on how to help accountants to start to utilize all of the offerings, such as the endless number of automations, that FYI offers?

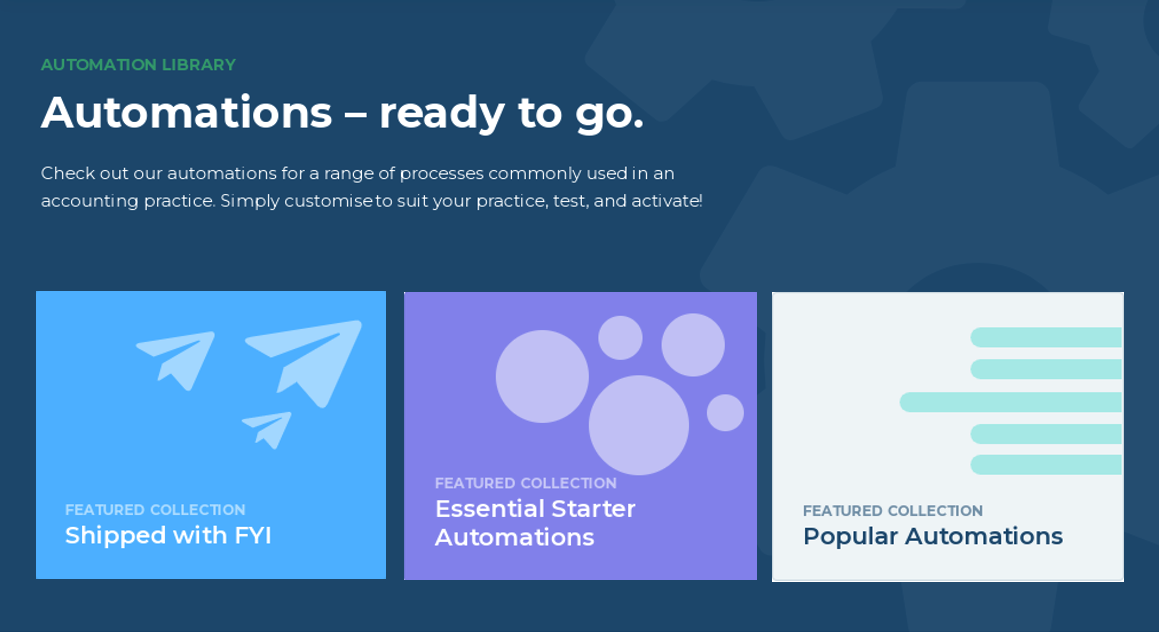

Absolutely. It’s our number one priority. We have our Masterclasses, and our recently launched Automation Library; it includes automations for a range of processes commonly used in an accounting practice. It spans everything from document import to email marketing, CRM, and compliance processes. And we have some really exciting automations for HR processes coming soon. These are either ready-to-go and the process steps can easily be imported, along with any email or document templates that form part of the process. Or you can follow our guides to set them up yourself.

Our sample processes have been well received by our clients and are a particularly handy way for practices to play around with automations when they are trialing FYI.

It’s been great to see the FYI community really jumping onboard, sharing ideas for automations and how they use FYI to streamline different tasks and workflows.

We’re also looking at creating more content and building a more structured community offering around it so people can share new ways of working and learn from each other.

When practices get to a certain level of confidence within automations, they start to figure it out and start creating more for themselves. Our job is to get the average firm using three to four automations regularly on a weekly or monthly basis, and then from there, we are very confident their team will continue to explore FYI’s capabilities and the firms will take off. Hopefully we can share successes with others through the community, as well.

We’re also planning to offer more masterclasses for FYI users to help our growing user base become more confident in creating and using automations.

What do you think the future is for FYI?

Saving more and more time for firms the further we move into the future – this is our fundamental ROI.

The future is very much extending process automation into all the elements of the business such as HR, marketing, and compliance while continuing to build valuable integrations with relevant app providers. Maximising the data that we can bring in from other apps is a big focus, and we’d like to end up with more than 50% of the data that’s been brought in being automatically filed – ideally extending to the point that even the vast majority of processing and communication is handled automatically.

We’ve got a well of rich data sitting in FYI, such as telephone calls, emails, calendars and documents and our plan is to start synthesizing that data together and making predictions of what users may do to assist them. We could fill in time sheets and present them for checking, for example. FYI might not get it 100% correct in every instance but getting it 70% or 80% correct would save loads of time. That is just one example – we have many more in the pipeline. With everything that technology can do for us, now is just such a wonderful time to be an accountant.