NSW firm onto a winner with FYI’s automations

PKF Newcastle & Sydney (PKF NS) is not only a part of the prestigious PKF Global network but with the other Australian member firms, ranks among Australia’s Top 10 advisory, accounting, and assurance providers. With a strong and dedicated team, PKF NS proudly serves their clients, setting themselves apart from traditional firms through their commitment to delivering innovative and agile problem-solving solutions.

PKF NS allocated a crack team to the rollout of FYI including Josh Gambrill (IT/Technical Director), Natalie Fahey (Financial Controller) and Stacie Shaw (Partner).

Reflecting on their early days at PKF NS, 20 years ago, the team recalls, “We were a 35-year-old firm, we were paper-based – there’s a whole bunch of stuff we were doing just because we’d always done it that way.”

The move to an paperless kicked off about 15 years ago, and a true document management system had been a long time coming, in 2020 alongside the planned move to GreatSoft for Practice Management and a bunch of other changes to the tech stack, the team turned their focus to FYI.

Seamless integrations

The firm chose Greatsoft for their integrated cloud practice management due to its willingness to build integrations with best-of-breed solutions. And they chose FYI for the same reason.

“We are really, really stubborn as a firm about having a single source of truth for all our client records, and not having to touch the same piece of data more than once,” says Stacie. “FYI is the most receptive to playing nice in the industry and building out those integrations with other parties – focusing on document management and automation, and allowing an integration to pull other functionality in.”

Together, Greatsoft and FYI are creating greater consistency for the practice, and a seamless experience for the client.

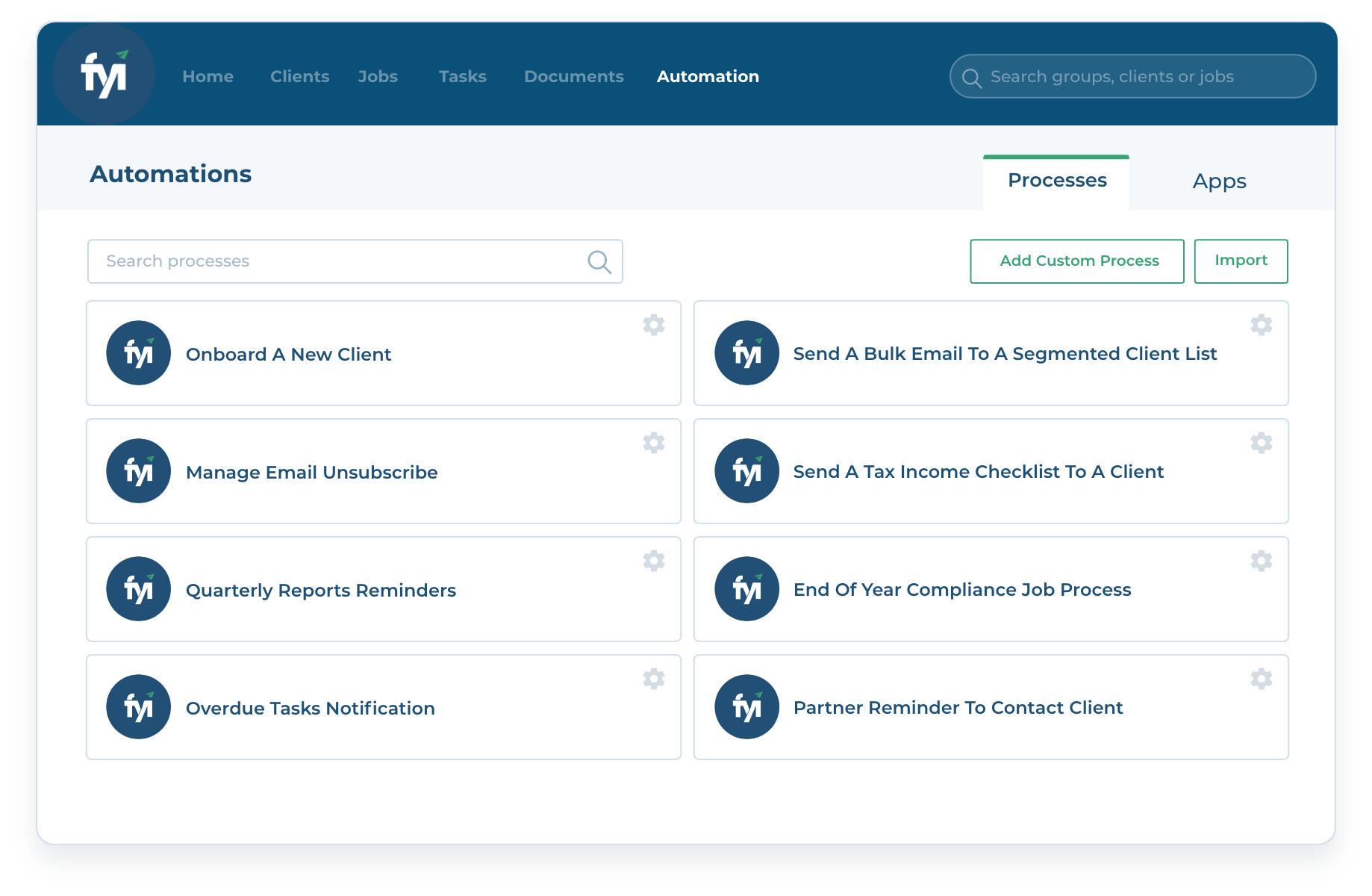

Winning with automation

While seamless integrations enable PKF NS to maximise efficiency, it’s FYI’s automations that have saved the firm seriously valuable time. “The time taken to set up a year-end job has been drastically reduced from 20 to 30 minutes to just two clicks and a three-second automation.”

When talking with other firms considering FYI, Stacie demonstrates the automation process by sharing her screen, showcasing the simplicity and transparency of the system. She explains, “There’s nothing up my sleeve. Just a couple of clicks, and all the relevant documents appear in the client’s renamed file, exactly where they should be. This eliminates human error, saves time, streamlines processes, and reduces our overall risk.”

Josh acknowledges the inherent limitations of relying solely on human involvement. “We’ve made a conscious effort to automate processes as extensively as possible and minimise human involvement. “Our goal is to free up reliance on ‘squishy humans’ and rely on efficient systems – which gives those humans more time back to be doing what they most enjoy and are best at – looking after our clients!”

By embracing FYI’s automation capabilities, PKF NS has successfully saved valuable time, reduced errors, and improved overall operational effectiveness. The firm’s commitment to leveraging technology to streamline processes highlights their dedication to delivering exceptional services while reducing dependence on manual interventions.

“In the past, we might have onboarded a new client into business services, and forgot to tell the superannuation team there’s a self-managed super fund they need to action – which becomes embarrassing for us both down the track when the client asks ‘Oh, why haven’t you started my super work?’. The client doesn’t care that we’re different teams – they just want a seamless experience with us holistically – just PKF NS”

But nothing is forgotten with FYI.

“We’ve built an onboarding automation inside FYI that does all the things you’d expect it to – creates the checklist, drafts the documents… tick, tick, tick. It also sends an email to our marketing team to say there’s a new client onboard for our comms; to the Super team to onboard the SMSF – and heaps more. We’ve taken the inefficiencies out of the things that make people go ‘Why don’t they remember to tell me?’ No one has to remember it anymore.”

Easy connection to Annature

FYI’s integration with Annature, the leading eSignatures and client verification supplier, was equally key.

Stacie explains, “Previously, we used to use a different signing platform that was fine, but still required a lot of manual intervention to upload, issue, chase, download, rename, file… but FYI’s seamless integration with Annature was a game-changer for our practice. You select the document, hit the ‘signature’ button in FYI and bam – you’re in Annature with an auto-drafted envelope ready to go. It’s taken the process from 30 minutes in a million clicks, down to five minutes and maybe three or four clicks”.

Keeping critical business ‘up’ and running

Naturally, the firm relies on uptime to keep business moving forward.

FYI has a deep understanding of how essential their software is for our business. Even a half-hour downtime can be a nightmare because it hinders productivity. Therefore, they take this responsibility extremely seriously and prioritise maintaining uptime.

The live service status page has also been a valuable resource to the team.

“FYI is great at keeping their outages page updated. So, if something’s not working right, we can bounce over there and get the support we need. And their ticket response time is incredible! We log a support ticket, and we get a super quick response. It helps us keep the team in the loop and tackle things smoothly”

The team emphasise that it’s not just the speed of the response, but also the level of care provided. “Very often, the response is ‘Can we jump on a call to go through this?’ It’s not about exchanging screenshots or annoying email exchanges. It’s about finding the quickest way to get to the root of the issue together.”

Rapid updates, uncompromised functionality

Another way FYI keeps business moving forward is with rapid updates.

Says Josh, “FYI is incredibly agile in terms of the speed that they’re rolling out features. Rolling out updates every week is huge – some vendors roll them out every quarter or six weeks, which can be a painful amount of time.”

But speed shouldn’t come at the expense of existing functionality. And with FYI, the firm doesn’t need to choose between them.

Says Stacie, “FYI balances agility and rolling out new features really well, without compromising the current service or functionality.”

Shared benefits across the network

The benefits of using FYI have been felt beyond Newcastle and Sydney.

Explains Stacie, “As a network, we all want to support each other. And obviously there’s no reason to duplicate effort across member firms. It’s great to be in the FYI family – to be able to share these automations across our networks, to maximise our efficiency out to our clients.”

We’re glad to have PKF NS in the FYI family as well.

Want to join? Take a live platform tour to see how your firm can win with FYI too.